- Mix & Match

- Ynab Not Importing Transactions

- Import Transactions

- Migrating From YNAB 4 - YNAB Help - You Need A Budget

One of the first steps you can take towards improving your finances is to start budgeting. But creating a budget and sticking to it doesn’t come easy to most people. One reason might be that it’s rarely taught in school, so most of us grow up without learning how to budget properly.

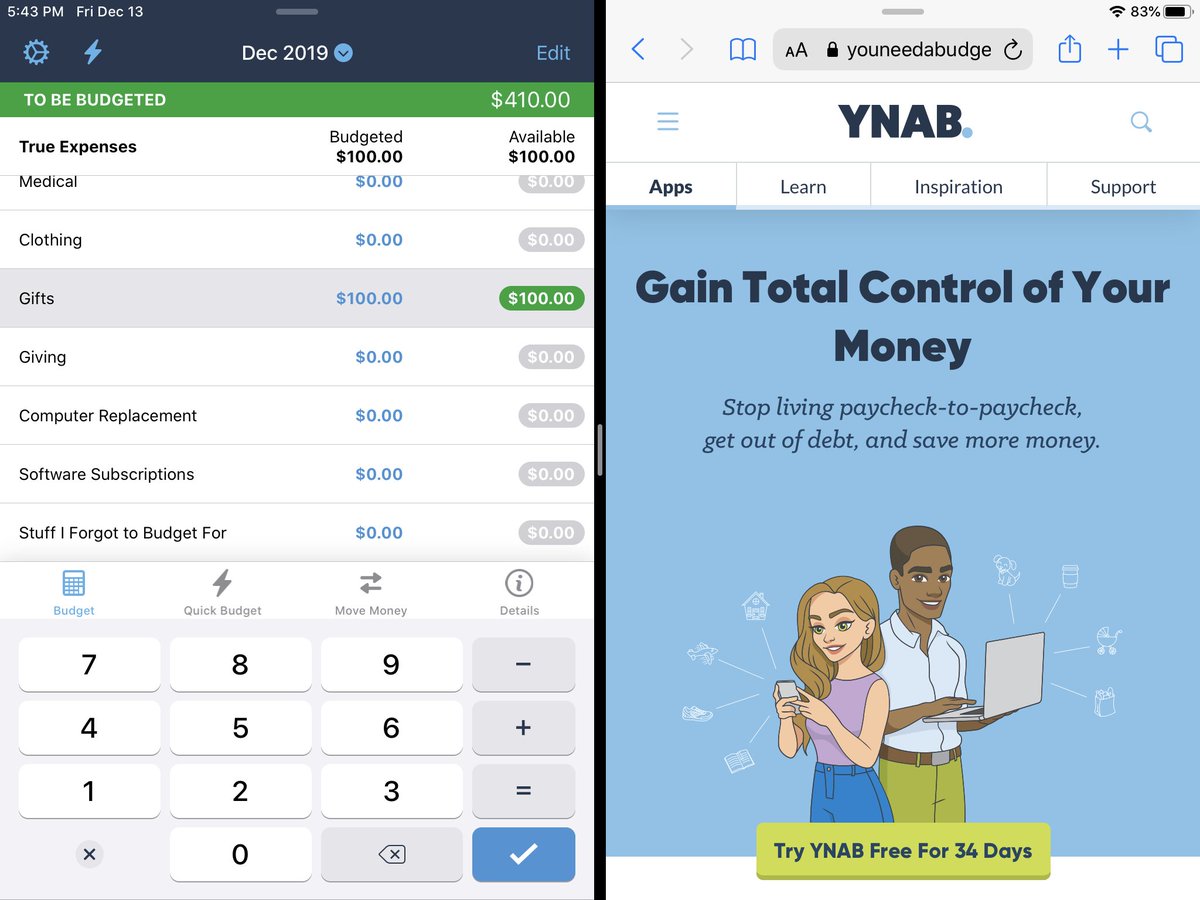

Thankfully, there are a number of budgeting software applications out there today that make it easy to create and maintain a budget. Perhaps you’re familiar with names like Mint, or Quicken. In this article, I’m going to introduce you to another popular budgeting software, You Need A Budget, or YNAB for short.

Introducing YNAB

YNAB emerged from humble beginnings more than 15 years ago, when newlyweds Jessie and Julie Mecham were looking for a way to manage their finances. Centered around 4 simple rules, they created a family budget that would eventually become YNAB, and as they say, the rest is history.

Mix & Match

Out of curiosity I decided to trial the new version of YNAB this morning. I like some of the new features like the goal setting which helps keep you on track but as far as i can tell you can no longer import bank statements which is a feature of YNAB 4 I really like when reconciling my accounts. Another week another update! You can now choose to import cleared transactions up to 10 days prior to the day you link a bank account. For new users the option is shown when setting up your account. For existing users there is a new option in the Settings menu should you wish to adjust it from the default. The way we’ve built the new YNAB you can have transactions imported directly from your bank (so fast! So easy!), but you still have to assign them to the appropriate category. Way less tedium, without losing awareness. Also, you can still use our mobile apps on the go, and manual entry if you choose. Or a combination of it all.

How to use YNAB – The 4 Rules

When you arrive at the YNAB website, you’ll notice that their budgeting philosophy is centered around 4 rules. Becoming familiar with the rules is the best way to understand YNAB. Let’s take a closer look at each one of the YNAB rules.

Rule #1. Give Every Dollar a Job

With YNAB, your first task when money comes in is to assign every dollar a job. Making a plan for every dollar and then following your plan will help you avoid one of the biggest budget killers – impulse spending.

Rule # 2. Embrace Your True Expenses

This rule will have you budgeting for the bigger ticket expenses that don’t occur as often, but that you know are coming around the corner. Your annual auto insurance premium or property tax bill are good examples.

If you’re not prepared, you may find yourself having to borrow from a line of credit to cover them, or worse yet, your credit card. This approach causes a snowball effect that can be very difficult to dig out from. YNAB helps you identify and plan for these expenses in advance by saving a small amount every month.

Rule # 3. Roll with the Punches

Let’s face it, there are times when you will overspend. When that happens, YNAB instructs you to roll with the punches, to be flexible. When your plan changes, your YNAB budget allows you to move money over from another category to cover the overspending.

Rule # 4. Age Your Money

When you follow the first 3 rules consistently, you’ll arrive at Rule # 4. This is the place where you are covering this month’s expenses from last month’s income. It’s the opposite of living paycheque to paycheque. 2018 r3 0 60. Ideally, you will be able to age your money by 30 days, which means always having a 1 month buffer to cover your expenses.

YNAB Features

When you set up your YNAB account, you’ll be able to sync your accounts for automatic data import. Some investment accounts, such as TFSAs, lack that functionality, but the system works well with your primary chequing/savings accounts, which is where most of your banking activity will flow through.

If you don’t like the idea of YNAB being connected to your web banking, you can import the files into YNAB on your own, or add account and transaction details manually. This is time consuming, but it will give you the most hands on control, which is probably how budgeting should be.

Here is a summary of what to expect when using YNAB:

- Budgeting philosophy based on ‘4 Rules’.

- Real time access on multiple devices allows for sharing with your partner

- Bank transactions can be downloaded onto YNAB (no automatic syncing)

- Goal tracking capability

- Colourful graphs and charts to help you keep track of your progress

- Email support and access to free, weekly workshops

- Data security with multiple levels of encryption

YNAB Mobile App

As with other web-based budgeting software programs, YNAB features a mobile app which can be downloaded for your iPhone or Android device. The YNAB app is $4.99, which is separate from the monthly YNAB fee, but it is only a one time cost. The app works well to input transactions on the go, saving you from having to play catch up later on.

YNAB Pricing

YNAB offers a 34-day free trial, to help you get a feel for the software before making a long term commitment. After that, their pricing is pretty straightforward, with both monthly and annual billing options.

- $11.99/Month – cancel anytime, or

- $84/Year – billed annually, cancel anytime.

- Optional YNAB iPhone app is $4.99 (one-time fee)

YNAB Member Support

One of the most important features of a software program is the support that comes along with it. Getting to know a new application can be tricky, so you want to know that help is close by when you need it. With YNAB, you get multiple layers of support. You have the option of reaching out to a YNAB representative via email, with an expected response within 24 hours.

In addition, YNAB also puts on 20-minute video workshops on a weekly basis, to discuss different budget-related topics. There’s a Q&A session at the end of each workshop. Wartune guild vault. You can also access their FAQ’s to get answers to most common questions.

Is YNAB Worth the Money?

Ynab Not Importing Transactions

So, why spend the $12/month on YNAB. Isn’t the purpose of creating a budget to reduce and limit your spending? If you ask me, this is one of those areas where spending a little bit of money can lead to saving even more money in the long run. The YNAB data seems to support this, too.

According to YNAB, new budgeters save around $600 in the first 2 months, and over $6000 in the first year using the app. That’s pretty significant, and definitely worth the money in my opinion. Of course, success requires that you stick with it, and follow the rules.

YNAB Pros and Cons

As with any software application, YNAB has lots of pros, and a few cons too. Here is my list, thankfully it’s weighted more heavily towards the latter.

Import Transactions

YNAB Pros

- Gives you the option to automatically sync or input accounts manually

- Accommodates goal setting, including irregular expenses

- User Interface is visually appealing

- Solid reporting to help you track your progress

- Great customer support including weekly workshops

- Risk free 34-day trial period

- Easy to use mobile app

YNAB Cons

- Monthly fee (Mint is free)

- Limited syncing with investment accounts

YNAB vs. Mint

Migrating From YNAB 4 - YNAB Help - You Need A Budget

Wondering how YNAB compares to Mint, another top budgeting app? If you are serious about budgeting, you can’t go wrong with either one. Both programs make budgeting easy and offer a range of tools to help you save. If there’s a difference between the two, it’s that Mint is very hands off. Everything seems to be done automatically. Mint will even send you an email each month so you don’t have to login to receive budget updates. Mint is also free of charge, which is a big plus.

If you prefer having everything done for you, Mint may be the way to go. However, I’ve always believed that a budget should be something you interact with. How else can you truly grasp where all of your money is going. You need to get involved. For this reason, I don’t mind paying the monthly fee to use YNAB. It’s also comforting to know that help is only an email away if I run into problems.

Final Thoughts on YNAB Budgeting Software

My overall view on YNAB is very positive. I love how it gets its users involved in the budgeting process. It’s designed to help you break the paycheque to paycheque lifestyle by using the ‘age your money’ concept, and that’s a good thing. It gives me a feeling of control, more so than with Mint, though Mint is a perfectly reasonable alternative. Not everyone will feel that the $11.99/month is worth it, but if it the end result is savings hundreds, even thousands of dollars, in my eyes it’s money well spent.